E-commerce sales of SEK 112 billion in the first half of 2019

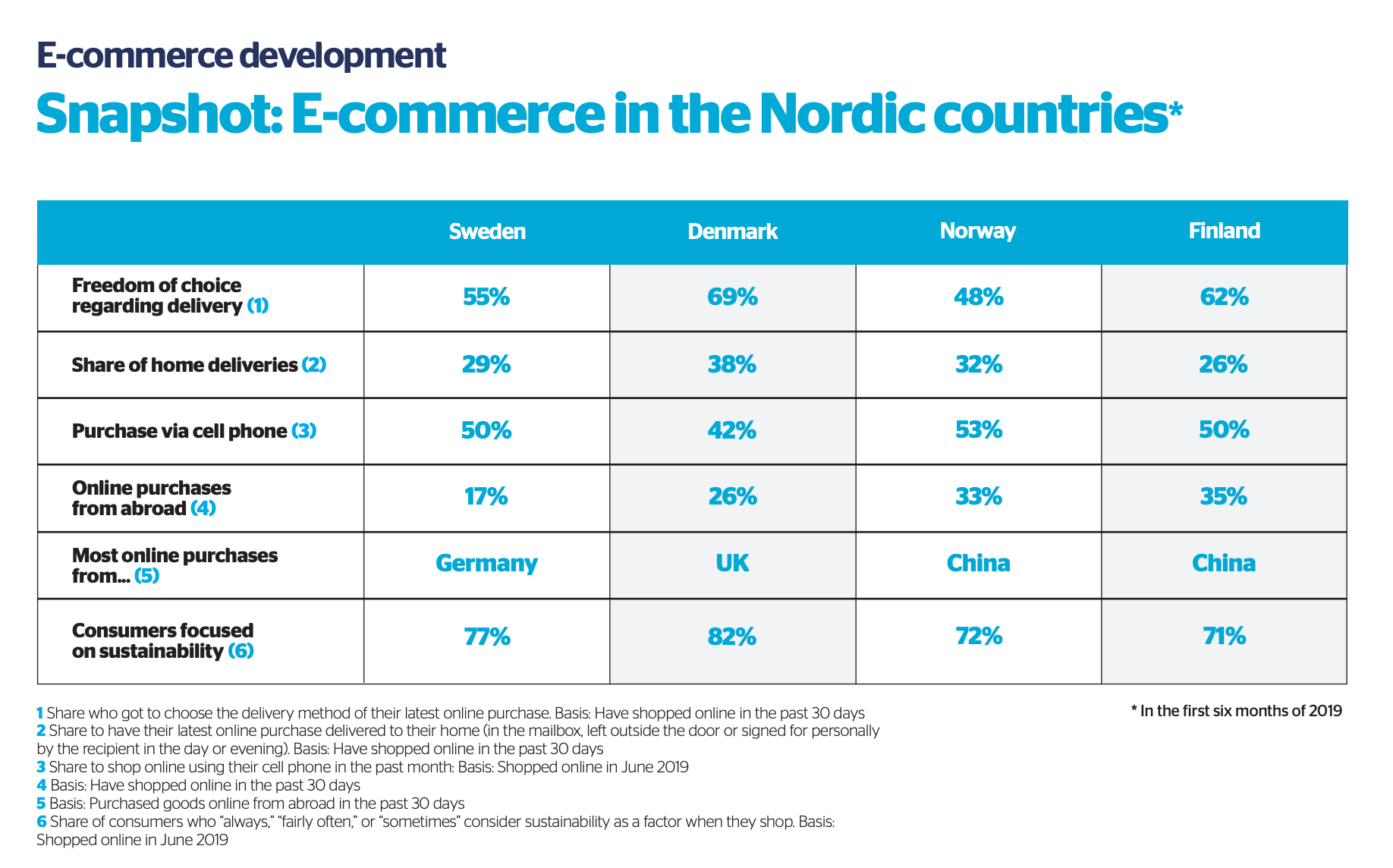

There are significant similarities between our Nordic e-commerce markets, but there are also considerable differences. That is made very clear in this half-year report 2019.

One thing consumers in Sweden, Denmark, Norway and Finland have in common is that many take sustainability into consideration when they shop for products online. More than one third of the Nordic respondents in our survey say that they always, or often, make sustainabilityconscious consumption decisions online. This is without a doubt often related to buying the right products, with as little environmental impact as possible. But the transports’ contribution to the equation is receiving ever more attention in the public debate. We also see in all four countries that there is a strong wish from consumers in regard to better adjusting the size of the parcel to the size of the product. These are topics we have come a long way with at PostNord, through different initiatives, not least in Sweden which is our biggest market.

Nordic consumers indicated spending SEK 112 billion online in the first six months of 2019. Swedes estimated spending a total of SEK 44.2 billion online, which corresponds with SEK 5,800 per person.* Following Sweden are the Danish and Norwegian e-commerce markets, respectively, which are comparable in size. Danes indicate spending SEK 26.1 billion in the first six months of the year (SEK 6,000 per person). Norwegians are just behind, with SEK 25.9 billion, corresponding with the Nordic region’s highest e-commerce consumption per person (SEK 6500). Finnish e-commerce continues to lag a bit behind the rest of the Nordic countries, amounting according to Finnish consumers’ responses to SEK 15.4 billion during the period, which corresponds with SEK 3,700 per person. The reason for the Finnish lag is primarily that fewer people shop online on a monthly basis in Finland than in the rest of the Nordic region.

The share of consumers who state that they shopped online from abroad has declined by several percentage points in all Nordic countries since last year’s survey. E-commerce from abroad is volatile and dependent on several different factors, including exchange rates, customs, fees and transport terms and conditions. One factor in Finland is that domestic e-commerce initiatives have taken off, which reduces the need to shop from abroad. Trade conflicts around the world and expanded customs fees may also influence where consumers choose to shop from, along with increased commitment to sustainability. All in all, Nordic residents indicated that they spent SEK 16.6 billion online from abroad during the first six months of 2019.

Increased share of e-commerce thanks to increased purchasing frequency

More and more Nordic consumers shop online. In the first six months of 2019, on average, 62% of Nordic residents shopped online per month, which is an increase of two percentage points compared with last year. The increase took place in Finland, Norway and Sweden. However, the Danish share was unchanged, and it is possible that high population density and proximity to physical shops in Denmark means that some consumer groups still have a limited need for e-commerce. Finland is still a bit behind the other countries, but on the other hand, the country increased its share by a significant five percentage points during the year. If e-commerce consumers continue to grow in number the way they did this year, it is conceivable that Finland will catch up to the other Nordic countries within just a few years.

What is the reason for this Nordic growth? A potential explanation is that shopping online for items which consumers purchase often has been on the rise in all Nordic countries. Purchases of groceries, pharmacy products and beauty products have grown and contribute to regular and recurrent purchases, which in turn add to the share of people who shop online on a monthly basis. On the other side of the spectrum are low-frequency but capitalintensive purchases such as household appliances and furniture, which are practical to buy online and have delivered home, and this raises the average purchase amount.

E-commerce in the Nordics six-month report 2019