Cross-border shopping and consumer spending in 2025

Global uncertainty remains high, with both conflicts and trade tensions affecting the Nordic countries’ growth negatively. Higher tariffs have increased the cost of both imports and exports. This has led to a growing worry in the Nordic region, that relies strongly on open trade.

However, household purchasing power has improved somewhat as inflation has stabilized and interest rates have eased, supporting real wage growth. Still, consumers remain cautious and prefer saving over consumption. Household spending is key to lifting the Nordic economies, and while confidence is slowly improving, it remains well below historical norms.

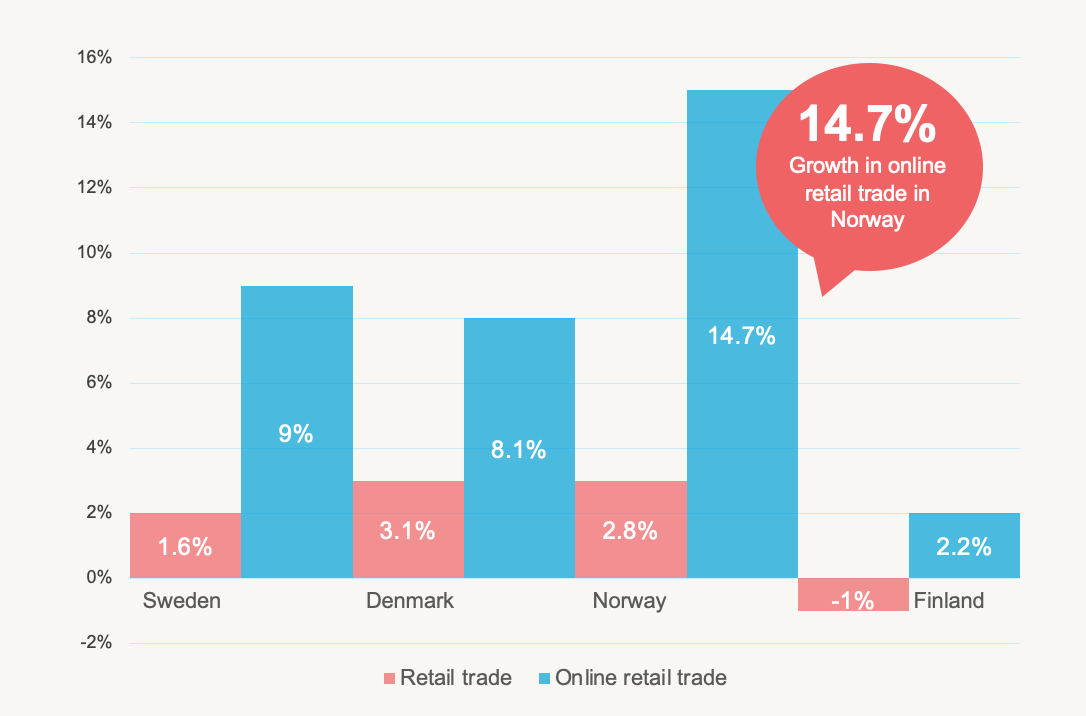

Overall, retail sales show a gradual recovery. All Nordic countries except Finland recorded positive retail growth in Q2 2025, with online retail as the main driver. E-commerce continues to outperform physical retail, boosted by consumers' demand for convenience, competitive pricing, and broader product availability.

The Nordic economies are expected to increase in 2026 and 2027, partly because households will have more money to spend as purchasing power improves. This provides extra room for consumption that will further boost retail trade.

Nordic e-commerce behaviour

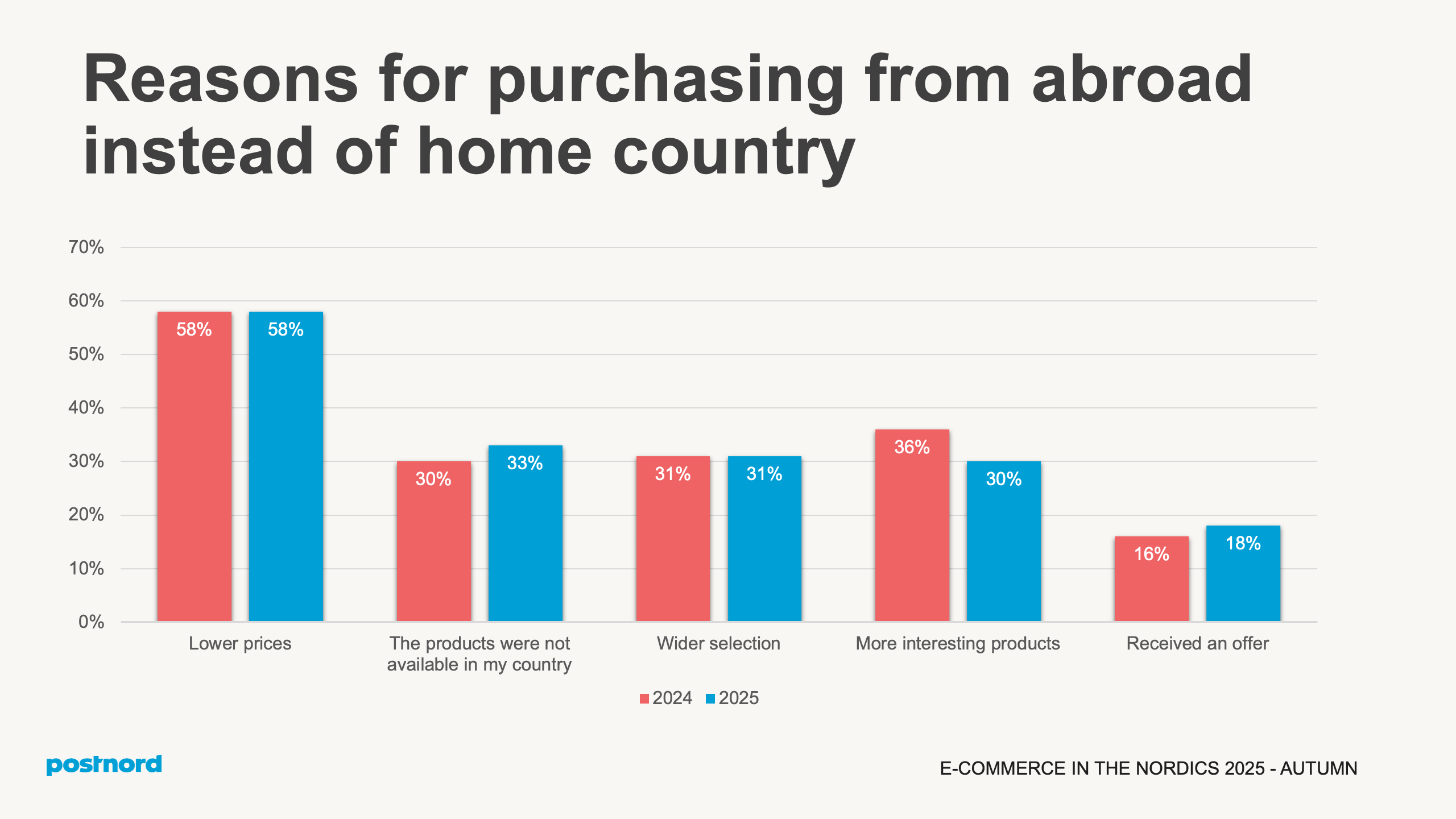

83 percent of Nordic consumers have shopped online during the last 30 days. Furthermore, shopping abroad has become more popular over the past year. About 8 out of 10 Nordic consumers have made a purchase online from abroad in 2025, an increase of 4 percentage points compared to 2024. China remains the most popular country to shop from for the Nordic consumers. That is reflected on the consumers’ reasons for shopping from abroad instead of domestically. More than 50 percent of those who have shopped from abroad state that lower price is the main reason for purchasing abroad.

In contrast to the increase in international purchases, at least when considering the sustainability factor, a majority of the Nordic consumers also engage in the second-hand market. Nearly 7 out of 10 Nordic consumers have bought or sold second‑hand items during the past three months. This behavior is even more pronounced amongst the youngest consumers, those aged 18–29, where the figure reaches closely to 9 out of 10. In other words, the younger consumers drive the second-hand market online.

Swedes turn more to online shopping from abroad

Online shopping from abroad is becoming more frequent among Swedes. 73 percent have shopped online from abroad during the past year, compared to 65 percent Autumn 2024. More consumers have shopped from abroad as the Swedish currency has strengthened during the year.

China remains the most popular country to shop from, gaining ground on Germany and Denmark. Swedish consumers mainly relate low prices and a wider range of interesting products with online marketplaces in China and Germany.

The amount of people purchasing from abroad due to an offer from a foreign retailer has increased from 12 to 17 percent since 2024. Large foreign retailers such as Temu and Shein have shifted parts of their marketing budgets from the US to Europe among other regions due to US tariff pressures on China. Advertising investments have increased in France and the UK, a trend that may also have affected Sweden.

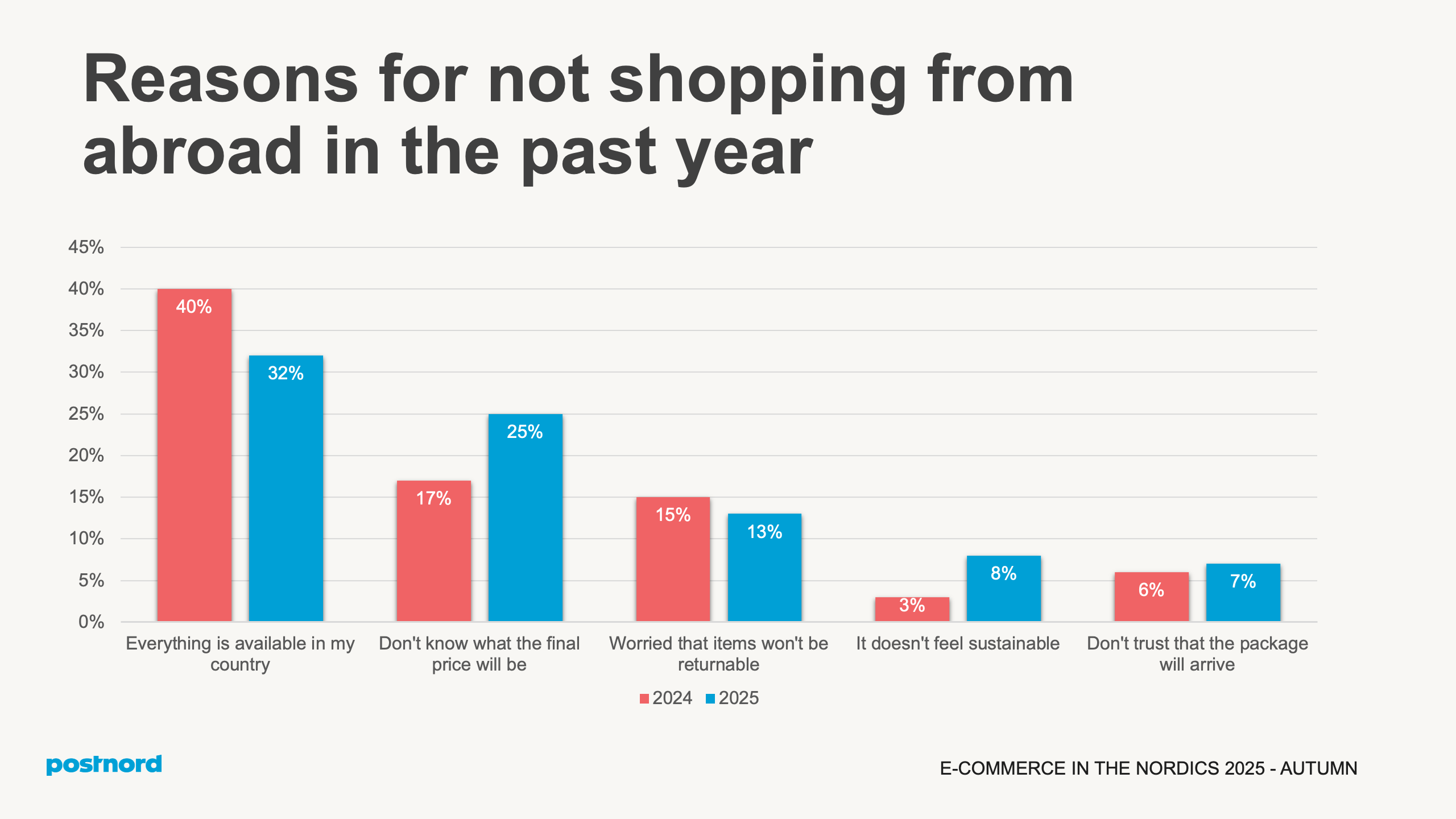

The most common reason why consumers do not shop from abroad is that everything is available domestically. However, this reason is cited less often than a year ago. Sweden is the largest and the most mature e-commerce market in the Nordics, thereby Swedish retailers might be quicker to adapt to international trends, indicating that more products are now available.

Cross-border shopping gains ground among Danish consumers

Cross-border shopping has become even more common in Denmark. 82 percent of consumers have made at least one purchase from abroad during the last year, compared to 80 percent the year before. One contributing factor is the increasing trust in international transactions. When looking at consumers’ latest purchase, China remains the most common country to shop from, but its share has declined slightly in favor of closer markets such as Sweden and Germany.

The Danish consumers are willing to look abroad when they see opportunities for better value or access to niche products unavailable domestically. Older consumers, aged 50–79, are particularly focused on lower prices, reflecting greater price sensitivity. Younger Danes, aged 18–49, are on the other hand more often persuaded by targeted online offers, reflecting their greater activity and presence in digital environments.

Fewer Danes now say they refrain from shopping abroad because they can find everything they need domestically. At the same time the perceived complexity of the buying process has become a more pressing barrier, suggesting that although the motivation to shop abroad is increasing, practical hurdles risk limiting this development.

More Finns shop online from abroad driven by price and selection

The share of Finnish consumers who have shopped from abroad has increased compared to 2024. 80 percent have shopped online from abroad during the last year, compared to 74 percent in Autumn 2024.

Sweden remains the most popular country to shop from, although losing market shares to Germany. Finns are the most price-driven consumers in the Nordics when shopping from abroad. Other important drivers are a wide selection and that the desired products are unavailable locally. More consumers purchased from abroad because the product they wanted was unavailable in Finland, compared to last year. This could partly be explained by social media trends, which might have increased demand for niche or micro-trend products, which are often found only on certain markets in the beginning.

In line with this, less Finnish consumers cite that they can find everything they need domestically as a reason for not shopping from abroad. Instead, an increasing number of Finns find it difficult to navigate foreign websites and have concerns over delivery reliability. This represents an opportunity for foreign retailers to address these issues to attract Finnish consumers.

Norwegians continue shopping abroad, driven by trends and choice

Norway has seen a slight decrease in the share of consumers shopping from abroad over the past year. While 81 percent of the Norwegian consumers still have made a purchase from abroad, this is down from 85 percent in 2024. However, Chinese retailers are still the most common to shop from and have increased in popularity, in terms of country for latest purchase

An analysis of why Norwegians shop from abroad shows that while lower prices remain the main driver, the absence of desired products domestically has become more important. Over the past years, micro trends and niche products have become increasingly popular and widely spread, especially through social media channels such as TikTok. At first, many of these products are only available on a limited number of markets, prompting consumers to turn to international websites in their search for these products.

When it comes to reasons for not shopping abroad, “everything is available in my country” remains the top factor, though its share has declined. Instead, consumers have become more wary of cross-border shopping, partly due to the tariffs recently imposed by the US. These have created market volatility and uncertainty, which is also reflected in the significant increase in the difficulty for consumers to predict the final price.

Key drivers of Nordic online shopping

Consumers across the Nordics are frequent online shoppers. Close to 70 percent made their most recent purchase in an online store, groceries excluded. What drives their online shopping choices varies by age group and country, influenced by local e-commerce development and access to delivery options.

Price matters to everyone, but in different ways. Younger consumers are the most price-sensitive, often comparing across platforms and switching retailers for the best deal. Older consumers, while still attentive to price, care more about product availability and familiar shopping experiences. For them, stability outweighs chasing the absolute lowest price.

Trust and satisfaction are key loyalty factors in the Nordic countries. In Denmark and Sweden, positive past experiences strongly motivate consumers to return to a certain website in the future. Finnish consumers, on the other hand, are more product-focused, prioritizing finding the exact item they need over sticking to a preferred store.

The Nordic consumers also value delivery options that fit their lifestyles. However, this aspect is more important for consumers in big cities than for consumers in the countryside. One explanation is that urban consumers are used to speedy deliveries and flexible pick-up locations, while rural consumers do not expect the same flexibility or speed in deliveries.