Nordic e-commerce on the rise

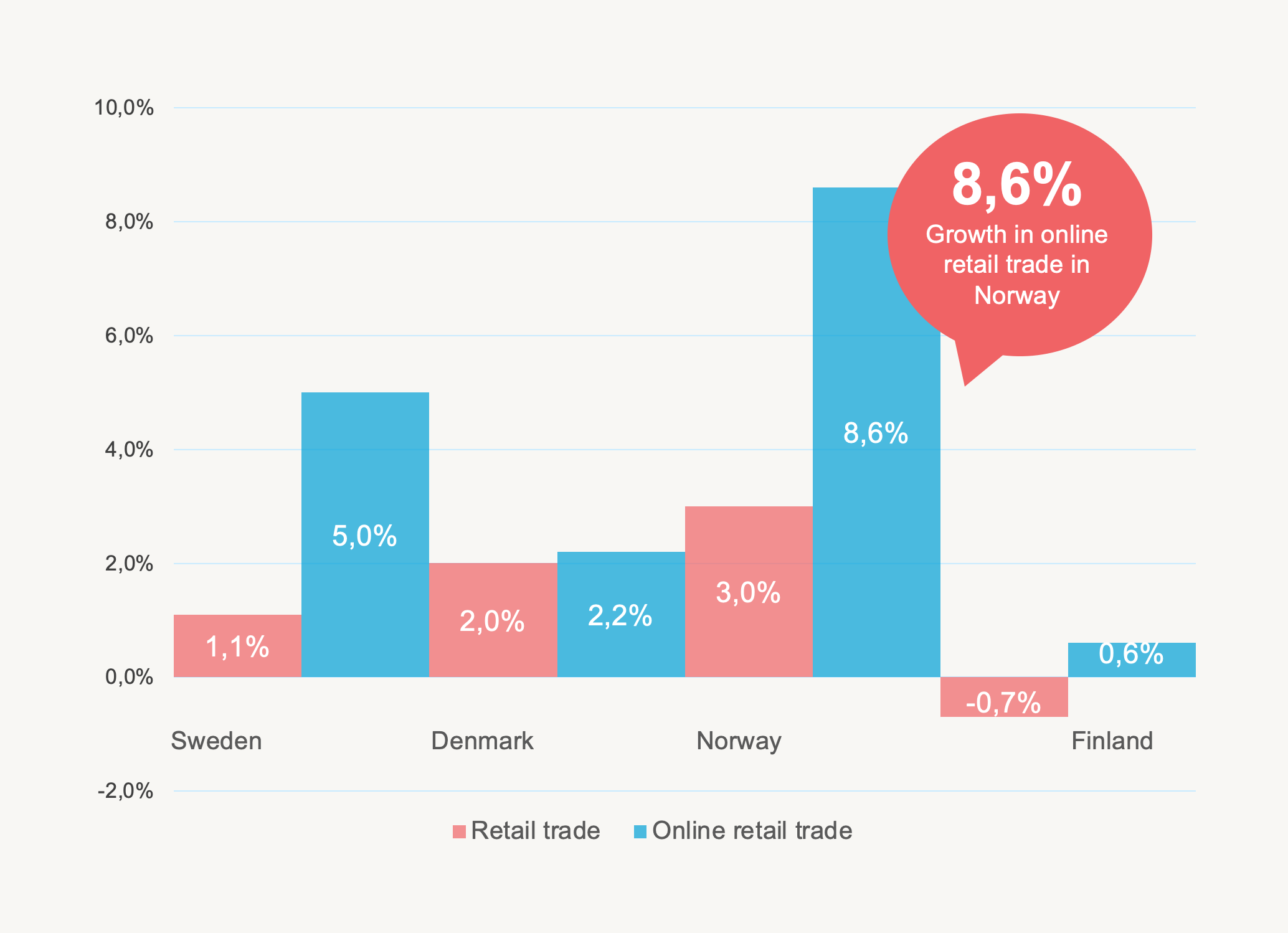

2024 marked a year of recovery for e commerce in the Nordic countries. Compared to 2023, online sales grew across all markets, even outperforming overall retail sales. In contrast, 2023 saw negative growth in most Nordic countries, with Norway being the only exception, showing zero growth.

Despite improvements in 2024, global uncertainties, particularly around tariffs and trade regulations, remain. Since e commerce is highly international, these factors can affect everything from supply chains to expansion opportunities. One likely outcome is an increased focus on the European market for both e tailers and consumers.

Unprecedented online shopping

Nordic consumers are highly digital and actively shop online. More than 80% of people shop online at least once a month, and over 70% have bought from international retailers in the past year.

The most popular product categories are clothing, shoes, home electronics, and beauty and health. These categories are consistent with trends in other countries. However, the specific products and prices can vary.

For example, cellphones are often bought domestically, while headphones are frequently purchased from abroad. Many consumers also shop from China due to lower prices. Nordic e commerce has grown quickly over the last ten years, outpacing total retail market growth in all countries since 2015.

Swedes lead the way in e-commerce

Swedes lead the Nordic countries in online shopping frequency. Economic improvements in 2024 boosted purchasing power and consumer confidence, encouraging spending on both essentials and everyday items. Sweden is the only Nordic country where groceries rank among the top three online categories, alongside home electronics. Popular international markets for Swedish shoppers include China, Germany, and Denmark.

Danish shoppers embrace online convenience

Online shopping is rising in Denmark, with more consumers making monthly purchases, though overall habits remain stable. Clothing and footwear continue to lead, but their popularity is slightly declining.

Gender affects shopping choices. Men prefer home electronics, while women favor beauty and health products. Clothing and footwear remain popular across both genders. The most popular international markets for Danish shoppers are Germany, Sweden, and China.

Finns increasingly opt for online shopping

Finnish consumers are increasingly convenience-driven and shop online more frequently, with younger Finns leading this trend. The overall number of consumers shopping online in the last 30 days has not changed much. However, younger age groups are shopping more often in 2025 than in 2024. The most preferred foreign markets for Finnish shoppers are Sweden, China, and Germany.

Norwegians prioritize choice and flexibility online

Norwegians value flexibility when shopping online and are frequent shoppers. Consumers aged 30 to 49 have the highest share of monthly shoppers, with increased shopping frequency in 2025 compared to last year.

The share of consumers prioritizing the ability to choose their delivery method rose from 69% in 2024 to 77% in 2025. Meanwhile, the importance of well-known brands and free delivery has slightly declined. The most favored international markets for Norwegian shoppers are China, Sweden, and the United States.

Sustainability drives Nordic shopping decisions

Sustainability continues to influence Nordic consumers’ online shopping choices. About 80% consider sustainability factors when making purchases, a slight increase from last year.

The recent recession has affected consumer behavior, with willingness to pay for sustainable options varying across the Nordics. Sustainable materials and fair working conditions are the top priorities. Swedes, Danes, and Finns place particular emphasis on sustainable materials, while Norwegians focus more on fair working conditions.

Economic recovery has allowed Nordic consumers to focus on sustainability instead of price. This is especially true in Sweden and Norway, where people are more willing to pay for eco-friendly deliveries. Interest in second-hand shopping also reflects this trend. Swedes show the greatest growth in both buying and selling used goods online.

Finland has seen the biggest increase in engagement, rising from the lowest levels in the Nordics last year to better participation in 2025. Additionally, more Finnish consumers now consider sustainability factors when shopping online, indicating a growing interest in more responsible consumption.

Download the latest data in the E-commerce in the Nordics 2025 Spring report to explore detailed insights and trends.